Becoming

the number 1

treasury system

One solution for all your cash and treasury management needs.

Trusted by 1400+ companies worldwide

Go beyond a great treasury management system

Clarity

Our number one goal is to provide you with clarity in both your daily and strategic operations. To achieve clarity, we offer more than just a TMS: our specialists help you get the most out of your tools.

.png?width=358&height=213&name=Frame%202100%20(1).png)

Knowledge

You can use our long-standing expertise in treasury to leave a positive mark on your team and organization.

Support

When you need help the most, we are there – whether it’s advising on your roadmap, implementing a new solution, or supporting you with daily challenges.

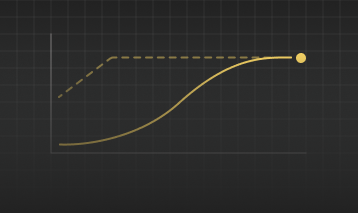

One system to elevate your treasury

Choose the Nomentia solutions you need and we will connect them

with all your banks, systems, and 3rd party data providers.

What our customers say

The best treasury teams boost their processes with Nomentia.

“We needed a global tool that could be used in all our locations to manage all payments. The goal was to create a harmonized way of working.”

Sirkku Markula

SVP, Corporate Treasurer

Kone

“Previously, we spent one week per month collecting data, and even then, we hadn't gathered and analyzed all the information. With Nomentia, we now have a comprehensive overview, and the data is imported automatically. This saves us tremendous time, which we can now fully dedicate to analysis.”

Stefan Bartel

Co-Head of Treasury and Finance

Union Investment

“We implemented a professional system to manage our group-wide financial status and liquidity planning at very short term. That helped us establish a professional Treasury function for BioNTech in a very dynamic environment.”

Dirk Schreiber

Vice President Treasury

BioNTech SE

What do you need help with?

Payment hub

A complete payment hub for automating, managing, and centralizing local, cross-border, and global payments. Connect ERPs, financial systems, and banks to process all payments.

Reconciliation

Automatically match bank statements with transaction data or post transactions to the general ledger.

Payment process controls

Built-in payment process controls for fraud prevention, treasury finance policies, and data validation. Automatically catch irregular payments before they are processed.

Sanctions screening

Automatically catch payments to sanctioned beneficiaries before they are processed. Screen your outgoing payments against any type of sanction list.

Bank connectivity as a service

Connect to over 10 000 banks globally. Fully managed connections and file format conversions between your banks, ERP, and financial systems.

In-house bank

Improve the group’s cash and treasury management processes by centralizing payment processes, liquidity and risk management, and taking control over intercompany financing.

Cash visibility

Monitor a complete and up-to-date cash position in centralized cash visibility solution. Automatically retrieve data from all internal and external systems and banks.

Liquidity management

Maximize visibility into your organization’s liquidity position, cash flows, and FX positions to optimize external & internal funding.

(e)BAM

A centralized multibank solution to manage all your bank accounts. Retrieve, view, analyze and monitor cash flows, account statements, and payments centrally.

Risk management

Implement a structured and systematic approach to risk management and hedging. Identify key risk drivers and optimally manage FX and interest rate risk during your day-to-day trading activities.

Cash flow forecasting

Automatically develop cash flow forecasts based on consolidated global cash flow data from all your systems and banks.

Guarantee management

Gain instant visibility into group-wide guarantees & LC status. Manage all processes related to internal and external guarantees in one platform.

Treasury reporting

Treasury reporting based on group-wide data from any system or bank. Easily export reports to BI tools or in other various formats if necessary.

Treasury workflows

Define workflows to streamline treasury processes. Centralize the work of various organizational units and multiple systems with Nomentia workflows.

Bank fee analysis

Automatically control and benchmark bank fees to avoid overcharges and ensure you don't pay the higher end of the market rates.

Loan management

Optimize the management of external bank loans and intercompany loans, integrate them into treasury processes, and measure their impact on cash flows and risk.

Integrate with the tools

you rely on every day

Nomentia integrates with the banks, systems and tools you use everyday.

Find out more

How can we improve your treasury together?

Our team is fully dedicated to provide you with the best possible implementation experience so you can get the most out of our solutions.

Select the solutions that you need.

Schedule a call with us to discuss your needs and the best next steps.

Set a timeline and start planning the project with our consultants.

Implement the solutions together with our dedicated specialists.

Security is in our DNA

Our utmost priority is keeping your operations secure. We take security seriously and we are ISMS ISO/IEC, ISAE 3402, SWIFT CSP, and FSQS-NL certified, and we are striving to get more certificates to gain your trust.

Find out more.png?width=549&height=375&name=Group%20427319601%20(1).png)

Discuss your needs

with our experts

Let's discuss the future of your treasury processes together.